so that you can either prepay or save up to pay education-related expenses. also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25. The CP14 will tell you how much you owe and request payment within 21 days, according to the Taxpayer Advocate Service, which notes that the letter is one of the most common notices sent to taxpayers. Read IRS Publication 970, Tax Benefits for Education to see which federal. Original music by Dan Powell, Sophia Lanman, Marion.

Irs gov plus up payment update#

To get an update on your third stimulus check using Get My Payment, enter your Social Security number, date of birth, street address and ZIP. Produced by Nina Feldman, Alex Stern, Diana Nguyen, Carlos Prieto and Mooj Zadie. However, if you don't pay the amount due within 60 days, the IRS can move to.

Irs gov plus up payment how to#

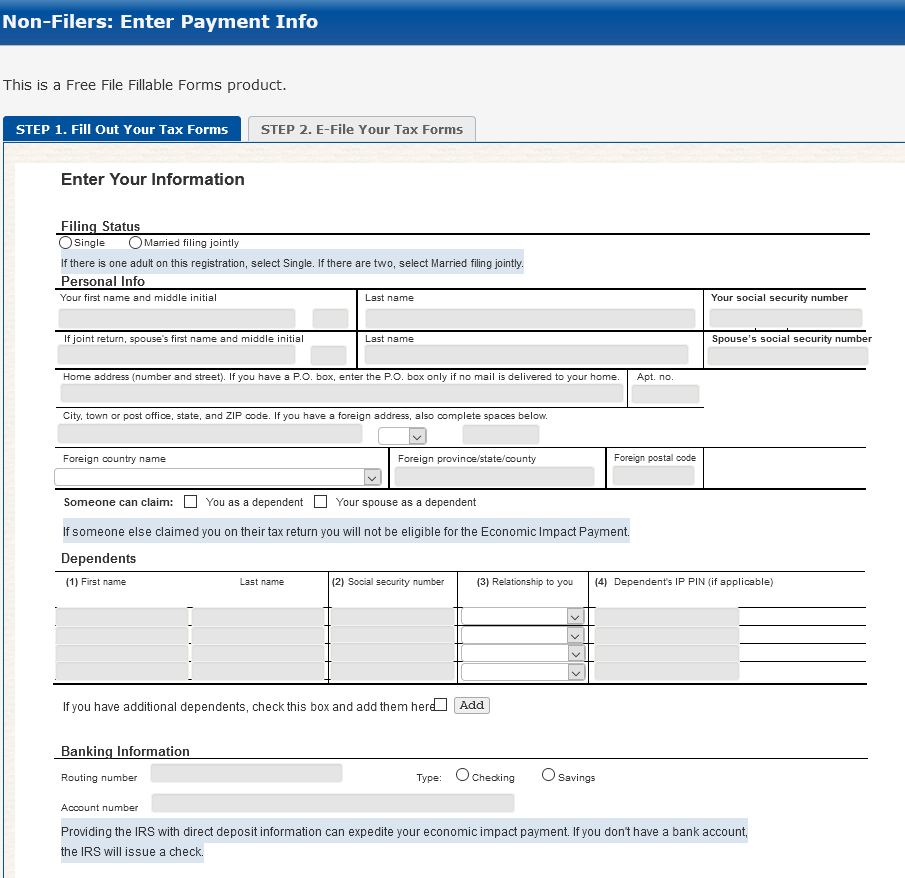

Heres how to get yours: Go to the IRS web page /coronavirus/non-filers-enter-payment-info-. The IRS charges 0.5 per month on unpaid taxes, up to a maximum of 25 of the total balance due, which can add up. The IRS sends a CP14 if it calculates that a taxpayer has a balance of more than $5 on their account, which can be related to a number of issues, such as failing to report some income or failure to pay a balance in full. IRS Get My Payment: How to use the online tracker tool. check, also known as the Economic Impact Payment. The IRS in February announced it would halt sending more than 10 types of letters that cover issues such as failure to file a tax return to under-withholding taxes. The first payments were up to 1,200 person and 500 per qualifying child. In 2020, the IRS issued two Economic Impact Payments as part of the economic stimulus efforts. The SEC offers a number of enhanced pay and benefits plus the standard.

Irs gov plus up payment free#

This year, the letter is unusual given that agency has stopped sending many types of notices and letters due to the pandemic. IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned Income Tax Credit (EITC). , along with your name and inquiry and we will be happy to. The IRS issues roughly 9 million of these letters annually, Steber said. It's important to pay attention to this letter - called a CP14 - because ignoring it could lead to penalties, according to Jackson Hewitt chief tax information officer Mark Steber. The IRS this month will send millions of letters to taxpayers whom it believes underpaid the tax agency.

0 kommentar(er)

0 kommentar(er)